- Payments app Zelle processes more payments than apps like Venmo.

- Several of the largest banks banded together to launch Zelle two years ago. It’s different from other payment apps because you don’t have to wait to receive the money in your bank account.

- Banks say they are benefiting from Zelle alongside consumers – Bank of America’s CEO said at a recent conference that the service is saving the bank money it would have spent processing paper checks.

- Here’s what Zelle’s all about, and how to use it.

- Visit Business Insider’s homepage for more stories.

The payments app Zelle quickly became popular among users. These days, the banks are loving it, too.

Zelle is a service that lets you digitally transfer money to someone else – no cash, checks, or wire transfers required. The service launched two year ago when JPMorgan, Bank of America, Wells Fargo, US Bancorp, Capital One, BB&T, and PNC joined together to launch Zelle.

Zelle is similar to the super-popular payments app Venmo. Both Venmo and Zelle let you send money to friends instantly, but there are some key differences between the two services: Money sent through Venmo can be transferred instantly with Venmo’s “instant transfer” feature, but Venmo charges a fee of 1% of the transfer amount if you go that route. Money sent through Zelle is transferred to your bank account automatically, free of charge.

This feature may have contributed to why Zelle has become so popular. According to eMarketer data, after only a year on the market, Zelle was poised to overtake Venmo as the most-used peer-to-peer payment app in the US. In the first quarter of 2019, Zelle processed $39 billion in payments, whereas Venmo processed $21 billion in payments during the same quarter.

And now, banks are starting to reap the rewards of Zelle and technologies like it. Bank of America CEO Brian Moynihan, for example, said at a recent conference that Zelle handled $44 billion in Bank of America customer transactions last year, which reduced the number of paper checks - saving the company the money it normally spends on processing those checks.

So what makes Zelle different from other payment apps, and how do you use it? Here's everything you need to know.

This is an update to a story originally published in 2018.

To get started with Zelle, download the mobile app. You'll be prompted to search for your bank right off the bat.

Once you locate your bank, you'll need to give Zelle permission to link your bank account to the app.

Next, you'll need to log into your bank account online. This is followed by several steps to verify your identity.

Zelle is very clear about what it will be accessing in your bank account. As with any app, it's a good idea to read the fine print before clicking "I agree."

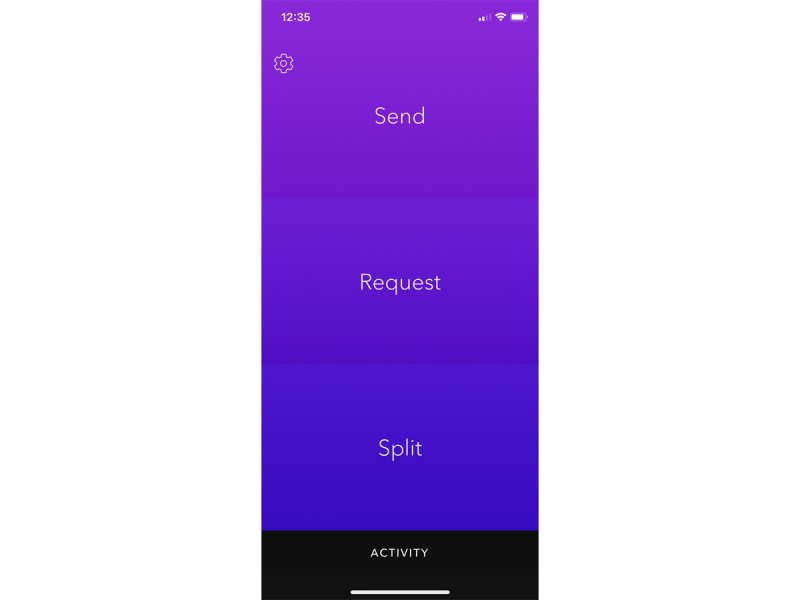

Once you're in, you'll see this screen. This is the home screen for the Zelle app, and you can probably already tell that it's pretty different from Venmo or other payment apps. There's no social feed, just three options: send, request, or split.

If you click on "Send" or "Request," you'll be prompted to choose from one of your phone's contacts. Once you've selected someone, it'll ask you for a dollar amount. You can also add a note explaining what the money is for.

Zelle has a $500 per week limit on how much money you can send, but if your bank offers Zelle, it may have different limits.

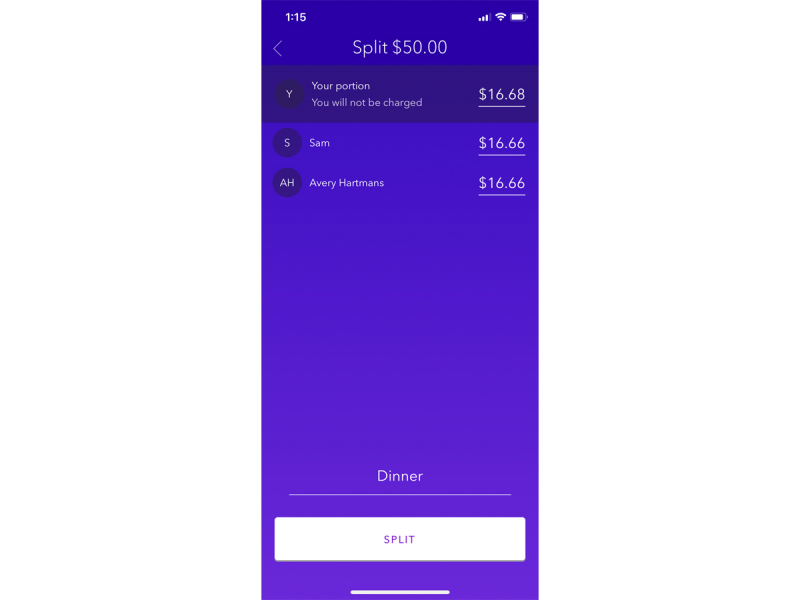

You can also split money using Zelle. This could be helpful if you made a group purchase — all you have to do is enter the dollar amount and select each person from your contacts list. Then, Zelle will calculate the cost per person.

Zelle keeps track of your activity within the service — it even tracked money I had sent from within my banking app (more on that in a minute).

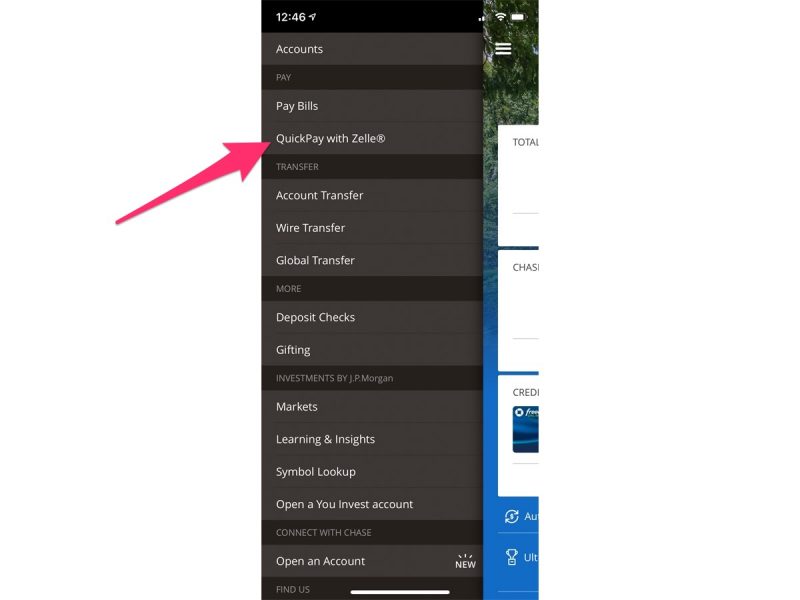

If your bank offers Zelle like mine does, it may be built directly into the bank's app. If I want to use the service, I can do so without having the separate Zelle app on my phone.

However, if you find yourself using the service a lot, you may like having the separate Zelle app, as it's a bit easier than logging into your bank account each time you want to send or request money.

But the best part about Zelle is that the money shows up in your bank account immediately. You don't have to wait several days for it to arrive. Plus, there's no fee for using the service.